In today's post we will explain GAAP and accrual accounting and address the following questions which are common among new board members, particularly those that are NOT accountants by trade, which means most people.

1. Why do accountants spell GAP with an extra A (GAAP)?

1. Why do accountants spell GAP with an extra A (GAAP)?

2. What is accrual based accounting and why do I care?

3. Does this have anything to do with why the year-end financial report at Boca Del Vista includes revenue from owner assessments at $500,000, when everyone knows that far less was collected?

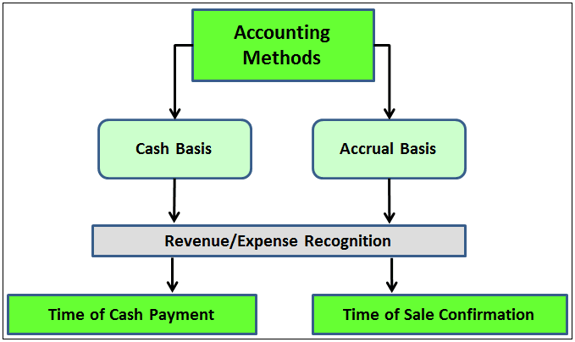

First off, GAAP stands for Generally Accepted Accounting Principles. GAAP is a framework and set of standards that are maintained by the Financial Accounting Standards Board (FASB), a private, not-for-profit organization whose primary purpose is to develop GAAP in the United States. If your condominium has more than $100,000 in income, your association is recommended by GAAP and required by law to use accrual basis accounting, as opposed to cash basis accounting.

Accrual basis reporting summarizes all income earned for the period, whether or not actually collected, and all expenses incurred during the period, whether or on not they were actually paid. Maintenance that has not been collected yet will go onto the balance sheet as “Accounts Receivable” and bills that were incurred in the period that haven’t been paid yet will go onto the balance sheet as liabilities, usually “Accounts Payable” However these amounts will not show in your “Income Statement” also known as a “Profit & Loss Statement” Which means that your monthly statement of income and expenses will show 100% of your maintenance fees as income - no matter how much is collected! This is why it is important to understand how to read both the balance sheet and the income statement.

If you live in a small association with $96,000 in income, then your monthly financial reports may show $85,000 in income for maintenance fees - the actual amount collected, because some people may be late or do not intend to pay, for a variety of reasons. This is called cash basis accounting. All the accounting is based on what is actually collected and actually paid for the period.

So why do associations have to use accrual accounting, cash accounting seems to make more sense?

The reason is because accrual accounting gives a more clear and stable picture, month to month, of the financial health of the association. The association is able to record income evenly over the 12 months, this is especially important if your association collects maintenance quarterly. The association is also able to make sure that large expenses like insurance, landscaping contracts, payroll, etc. are spread out evenly over 12 months instead large fluctuations month to month based on when the actual checks were cut.

For example, a large HOA may have a landscaping contract that is $15,000 per month. Under cash accounting if the check for February services wasn’t cut until March 1st, and then the check for March services is cut March 31st, the financial will show $30,000 of landscaping in expense in March and $0 in February. This could give someone the impression that the association had run a budget surplus in February, and a budget deficit in March, but in reality both months should have been right on budget. Accrual accounting allows the association to record the expense for February services in February even if they haven’t written the check yet, because the association knows they owe the money for that month.

An association that collects maintenance quarterly has a different issue. Everyone’s maintenance is due on January 1st for the first quarter of the year. This means that if everyone pays on January 1st like they’re supposed to, the association will show what is in reality three months of income in January, and $0 of income in February and March. This would lead to a very distorted financial every month. Accrual accounting allows the association to record 1/3 of the maintenance collected in January, 1/3 in February and 1/3 in March, this gives a clear, even financial picture of the month to month performance of the association. These are relatively simple examples, but they clearly illustrate the need for an accounting method to record income and expenses on consistent basis month to month.